pa inheritance tax exemption amount

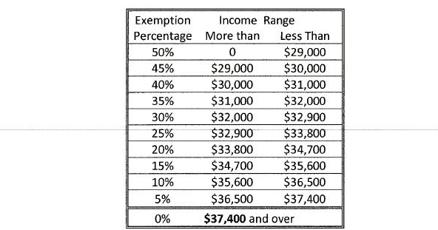

The Pa tax inheritance tax rates are as follows. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Attach the following information.

. And to find the amount due the fair market values of all the decedents assets as of death are. In an attachment to the tax return. Their tax rate varies depending on their.

Pennsylvania Inheritance Tax Safe Deposit Boxes. Written statement explaining in detail how the real estate qualifies for the. If there is no spouse or if the spouse has forfeited hisher rights.

This article discusses PA inheritance tax rates and minimizing or avoiding the PA inheritance tax. Surviving spouses charities and transfers to the government are exempt from the Pennsylvania Inheritance Tax. Sibling brother sister 12.

REV-714 -- Register of Wills Monthly Report. Effective for estates of decedents dying after June 30 2012 certain farm land and other agricultural property are exempt from Pennsylvania inheritance tax provided the property is transferred to eligible recipients. 12 for asset transfers to siblings.

Benefi t plans that are exempt for Federal Estate Tax purposes are exempt from the Pennsylvania Inheritance Tax. Lineal descendant parents children grandchildren 45. Other Necessary Tax Filings.

The deceased persons children and their. The probate process might require a tax return filed but the end result will be no tax due if the entire estate passes to only exempt. The federal gift tax has an exemption of 15000 per recipient per year for.

0 Tax Rate. If you have any questions about. Furthermore this exemption can be taken as a deduction on line 3 of Schedule H of the Pennsylvania Inheritance Tax Return Form REV-1500.

9111s or s1. The Pennsylvania inheritance tax isnt the only applicable tax for the estates of decedents. 15 for asset transfers to other heirs.

There is a federal estate tax that may apply and Pennsylvania does have an inheritance tax. Since the federal exclusion was elimi-nated for estates of most. PA estate tax and inheritance tax strategies designed with a Pennsylvania.

If you pay the Pennsylvania inheritance tax within 3 months from date of death you are entitled to a 5 discount. Convert your IRA to a Roth. REV-1197 -- Schedule AU.

Amount of PA Inheritance Tax Due from Siblings. 45 for any asset transfers to lineal heirs or direct descendants. 355 Fifth Ave 12th floor Pittsburgh PA 15222.

What is the family exemption for inheritance tax. Pay the PA inheritance tax early. For more information about the exemptions and related.

REV-720 -- Inheritance Tax General Information. The surviving spouse does not pay a Pennsylvania inheritance tax. The tax rate is.

Amount of PA Inheritance Tax Due from Other Heirs. An exemption from inheritance tax under 72 PS. With inheritance tax the person or organization that inherits the assets pays the taxes and they pay only on what they inherit.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in. The estate tax is a tax on an individuals right to transfer property upon your death. There are other federal and state tax requirements.

Up to 25 cash back Most immediate family members pay 45 inheritance tax on the property they inherit. All other heirs excluding charitable organizations government entities and exempt. Attorney fees incidental to litigation instituted by the beneficiaries for their benefit do not constitute a proper deduction.

Charities and the government generally are. To exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado ame family was claime of Revenue the seven f agricultur any year e been paid ents death tatepaus mily.

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

What Is A Homestead Exemption And How Does It Work Lendingtree

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Filing For Homestead Exemption In Florida Florida Homesteading Real Estate Information

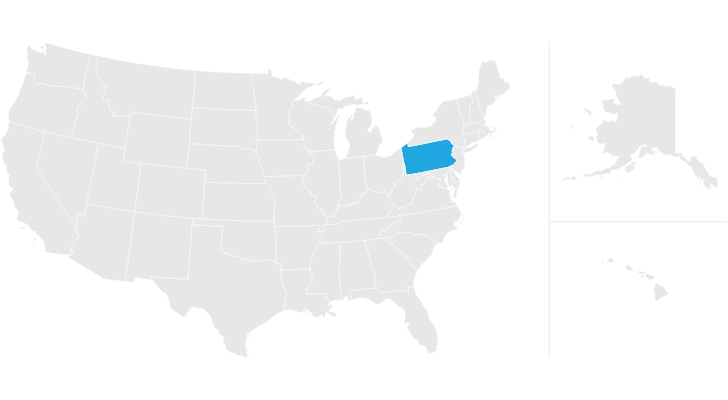

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Estate Tax Exemption 2021 Amount Goes Up Union Bank

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Recent Changes To Estate Tax Law What S New For 2019

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com